About Tax2u Ltd

Tax2u Ltd are an experienced accountancy service provider* specialising in supporting our customers to deal with

– UTR and CIS registration (regsiter for your UTR now)

– CIS tax rebates (choose a service)

– PAYE and Employment Tax Rebates (find out if you’re due tax back)

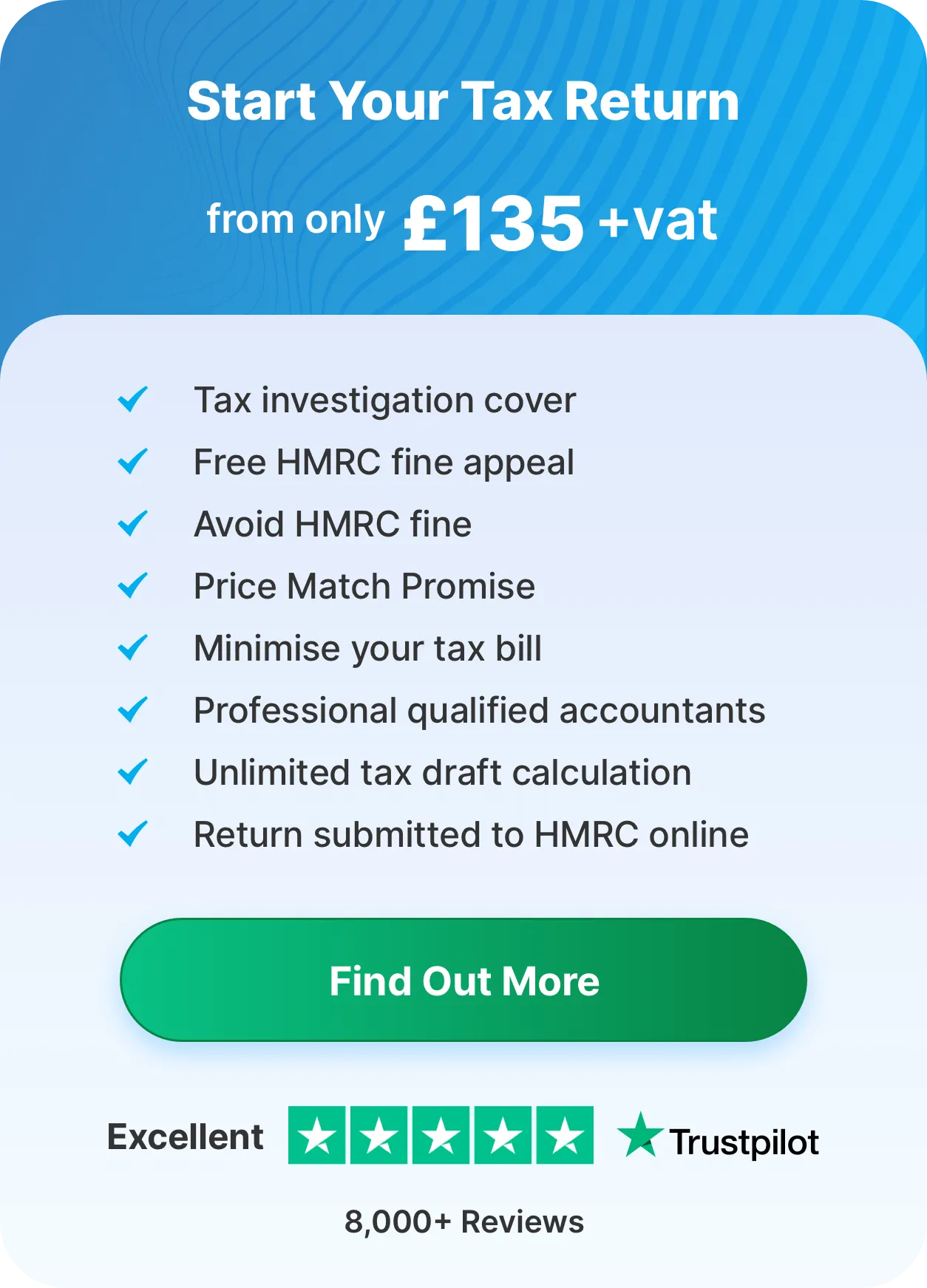

– Self-assessment tax returns (choose a service)

Anyone who is self-employed must complete a self-assessment tax return at the end of the tax year (5th April of every year) and at Tax2u Ltd we know that this can be a complicated process, so we do the hard work for you. click here to find out more about becoming our client

* Tax2u Ltd is a registered accountancy service provider as defined by HMRC. Tax2u Ltd are a registered HMRC agent** which allows us to act on our client’s behalf and deal directly with HMRC on their tax related issues.

** this does not mean that we are endorsed by HMRC.

If you’re owed tax back, we’ll get it for you.

Our team specialises in reclaiming overpaid tax for our clients. With your permission we’ll investigate your recent employment history to find out if you’ve overpaid tax or not. Find out if you’re due tax back click here

If you are self-employed and paid CIS tax in any period we’ll ensure we recover it for you.

If you’re self-employed and due to submit a tax return we’ll ensure that we claim back all your allowable business expenses to reduce your tax bill.

We have made the process as simple as possible – all you need to do is send us your payslips or invoices and any receipts you have relating to work.

You can send this to us either by;

· Uploading everything to your Tax2u Ltd online account

· Email us at [email protected]

· Or WhatsApp us on 020 7118 0097

We do the rest!

There are two main services that we offer

- PAYE / Flat Rate Expenses Tax Rebates

- Self Assessment Tax Returns

- If you work in Construction

- If you work as Self Employed with UTR

Self-Assessment Tax Return

EVERYTHING YOU NEED TO KNOW ABOUT CLAIMING BACK YOUR CIS TAX

Income Tax

CONSTRUCTION INDUSTRY SCHEME (CIS) REGISTRATION

You don’t have to register if you only do certain jobs, including:

· Architecture

· Surveying

· Consultancy work

· Scaffolding hire (with no labour)

· Carpet fitting

· Making materials used in construction including plant and machinery

· Delivering materials

· Work on construction sites that’s clearly not construction, e.g. running a canteen or site facilities

CIS applies to people who work in construction only.

Under the Construction Industry Scheme (CIS), contractors deduct money from a Subcontractors payments and pass it to HMRC. The deductions count as advance payments towards the Subcontractors tax and National Insurance.

HMRC provide a personal allowance* of income before you are eligible to pay tax. By completing a self-assessment tax return after the tax year closes may mean you are due a rebate.

*Personal allowance in Tax Year 2024-25 – £11,850

*Personal allowance in Tax Year 2024-25 – £12,500

Once we submit your application for your UTR* or your UTR & CIS** it will take up to 4 weeks for HMRC to post this out you.

During this 4-week turnaround time there is no emergency tax code that can be applied. You will be deducted 30% tax while you wait for your UTR & CIS to arrive. Once this arrives and is active with your employer your tax will reduce to 20%.

We can help you to reclaim any overpaid tax at the end of the tax year.

If you are self-employed and YOU ARE working in the Construction Industry (CIS) you can work without a UTR & CIS, however this will affect how much tax you pay.

You will pay 30% tax without a UTR & CIS and this will reduce to 20% when your UTR & CIS are activated.

We can help you to reclaim any overpaid tax at the end of the tax year.

The scheme covers all construction work carried out in the UK, including jobs such as:

· Building works

· Site preparation

· Alterations

· Dismantling

· Construction

· Repairs

· Decorating

· Demolition

FLAT RATE TAX CLAIM

You should complete a PAYE tax claim form if:

- You had worked and paid taxes anytime in the last 4 years

- You incur work expenses that are ‘allowable’ for tax relief

- The annual total of the work expenses you are claiming for is under £2500. If your expenses are £2500 or over, you will usually need to complete a Self Assessment tax return

The extent of tax relief that you will receive completely depends on the rate of tax you pay. For instance, if you’re a basic rate taxpayer who claims tax relief on £1,000 on allowable expenses, you are liable to obtain £200 which is 20% of £1,000.

If you file for tax relief claim for the current tax year, HMRC will adjust your tax code like it normally does and subtract less tax so as to account for this. If you’re claiming tax for a previous year, you’re likely to receive a cheque or bank transfer for the total amount you’re owed.

HMRC, FINES AND APPEALS

If you have told HMRC that you are self-employed then it doesn’t matter if you worked one day or even no days as self-employed. As far as HMRC are concerned you are registered as self-employed and they will not have visibility of the actual hours/days you work.

As someone who is self-employed it is your responsibility to keep HMRC updated of your working status and earnings throughout the tax year. This is done by submitting your self-assessment tax return. Failure to submit a self-assessment tax return can lead to HMRC fining you which could amount to £1000s. For support with your tax return please email [email protected]

If you have received a letter detailing a fine from HMRC or we have notified you of a fine you need to act on it swiftly. Failure to act on a fine letter will result in the fine increasing until your HMRC account is brought up to date.

Don’t panic, we can help you with this.

In the letter it will explain which tax year HMRC is missing your information for. All you need to do is send us your income information from that year and we complete your tax return and submit it to HMRC.

We also appeal your fine for you throughout this process.

We cannot guarantee the fine will be removed from your account, but we have a 90% success rate in removing fines from our client’s HMRC accounts.

SELF ASSESSMENT & TAX RETURNS

If you are self-employed for any period during a tax year then you will need to complete a self-assessment tax return this includes;

A full tax year self employed

Part tax year as PAYE* and part self employed

Not working and then going self employed

*PAYE is the tax you pay under The Pay as You Earn (PAYE) system. This is how you pay both your income tax and national insurance (NI). Every time you’re paid, your company takes your tax and NI from your wages and sends it on to HMRC.

We have set up a hassle-free approach to helping you complete your self-assessment tax return.

Please send the following information to [email protected]

• Payslips/wage slips/invoices or bank statements to prove your income

• Work related receipts expenses for what can be claimed back on

• CIS Deduction Certificates (applies to CIS employees only)

Work related expenses are TAX DEDUCTIBLE which is not the same as being refunded.

For example, if you earned £15,000 in the tax year 2024-2025, this is how we would calculate it; Total income; £15,000 minus expenses; £2,000 equals total profit; £13,000*

*Please note that this does not consider any National Insurance contributions.

Once we have received your information we calculate based on your income, minus your expenses to gives us a total profit. Click here to claim to claim your tax rebate.

For example, if you earned £15,000 in the tax year 2024-25 this is how we would calculate it; Total income; £15,000 minus expenses; £2,000 equals total profit; £13,000

We use the profit to work out how much tax you either owe to HMRC or if you need to get a refund from HMRC for the tax year* and then we send you a copy of the draft for your approval. Once you have confirmed the draft we forward it to HMRC to get it processed. This can take up to 4 weeks for HMRC to process.

*If you are under CIS and have been paying tax throughout the year you may be eligible for a tax rebate.

UNIQUE TAXPAYER REFERENCE NUMBER (UTR NUMBER)

Your Unique Taxpayer Reference (UTR) is a number that HMRC uses to identify you for everything to do with your taxes.

If you are or planning to be self-employed it is critical you have a UTR number so that you can complete a self-assessment tax return at the end of each tax year (tax years run from 6th April to 5th April the following year).

If you do not complete a self-assessment HMRC will apply fines to your account.

The scheme covers all types of businesses and other concerns that work in the construction industry, including:

- companies

- partnerships

- self-employed individuals

These businesses can be:

- contractors

- tax2u

- contractors and tax2us

Under the scheme, the terms ‘contractor’ and ‘tax2u’ have special meanings that cover more than is generally referred to as ‘construction’.

Contractor – A contractor is a business or other concern that pays tax2us for construction work.

Contractors may be construction companies and building firms, but may also be government departments, local authorities and many other businesses that are normally known in the industry as ‘clients’.

Some businesses or other concerns are counted as contractors if their average annual expenditure on construction operations over a period of 3 years is £1 million or more.

Private householders aren’t counted as contractors so aren’t covered by the scheme.

tax2u

A tax2u is a business that carries out construction work for a contractor.

Businesses that are contractors and tax2us

Many businesses pay other businesses for construction work, but are themselves paid by other businesses too. When they’re working as a contractor, they must follow the rules for contractors and when they’re working as a tax2u, they must follow the rules for tax2us.

Once we submit your application with HMRC it will take up to 4 weeks for HMRC to send you a letter with your UTR number.

If you are self employed and not working in the construction industry anything you earn over the personal allowance for the tax year is eligible for tax.

We can help you to complete your tax return and help you pay your tax bill in a timely manner.